Enterprise Zone, Property Tax Abatement: Ashland, through the support of Jackson County, has adopted an Enterprise Zone, which offers property tax abatement incentives to eligible companies for 3-5 years on all new capital improvements made. This program requires an increase in jobs of 10%, or a minimum of one job created in Oregon in the zone. In order to qualify for the incentive, the company must submit an application before breaking ground, making improvements, or purchasing equipment. There are three levels of Enterprise Zone abatement.

Standard Enterprise Zone: The Standard Enterprise Zone is as-of-right for qualifying companies and offers 3 years of property tax abatement for new capital improvements made. Program eligibility is:

Extended Enterprise Zone: The Extended Enterprise Zone may offer 4 to 5 years of property tax abatement on new capital improvements made. In addition to the eligibility requirements for the standard enterprise zone, the company must:

Long-Term Rural Enterprise Zone: The Long-Term Rural Enterprise Zone may offer 7 to 15 years of property tax abatement on new capital improvements made. In addition to the eligibility requirements for the standard enterprise zone, the company must:

Click here for a map of the Enterprise Zone in Ashland.

The application process for the Enterprise Zone goes through SOREDI (Southern Oregon Regional Economic Development Inc). For information, contact Executive Director, Ron Fox at (541) 773-8946

Click here for the pre-certification application provided by SOREDI

An additional program applicable to all Enterprise Zones, if adopted, is the E-Commerce (or Electronic Commerce) Overlay. "Electronic commerce" is defined as engaging predominantly in transactions via the internet or an internet-based computer platform. These transactions can include taking orders, closing sales, making purchases, providing customer service or undertaking other activities that serve the business's overall purpose, even if retail in nature. The most significant feature of these designations is that qualifying businesses may receive a credit against the business's annual state income or corporate excise tax liability.

The tax credit equals 25% of the investment cost made in capital assets used in electronic-commerce operations inside that enterprise zone. To make the investment means to have incurred the financial liability or commitment for the asset in that income tax year. Capital assets are property used in the business, the cost of which may be depreciated for federal income tax purposes. The annual maximum credit amount is $2 million per year. Unused tax credit amounts may be carried forward over the next five years. The credit is claimed directly on corporate or individual tax returns, and while there is no additional form required, the taxpayer must maintain records of purchased assets.

The application process for the E-Commerce overlay within the Enterprise Zone is also managed through SOREDI (see above). Contact the Executive Director, Ron Fox, at (541) 773-8946

A business may qualify for a SOREDI loan if it will be creating jobs in Jackson or Josephine County and you need financing for;

non-speculative land purchase

new buildings

machinery and equipment

start-up and working capital

Loans from $10,000 to $250,000 are available through the SOREDI loan process and loans may be made up to $950,000 with the addition of Oregon Business Development Fund (ODBF) funds through Business Oregon. Terms range from 3 to 10 years and must be collateralized. SOREDI charges a competitive interest rate ranging from 2 percent under prime rate to 4 percent above prime with a minimum rate of 8% (currently in effect). Rates are fixed for the life of the loan with no pre-payment penalty. A loan fee of 1.5% is charged on each loan and the borrower is responsible for any out of pocket expenses incurred. A loan candidate must create at least one job for every $15,000 to $20,000 borrowed. The borrower must further have an equity position of at least 10 percent of the project amount and the loan cannot fund more than 75% of the project other conditions may apply and the business plan must show reasonable prospect of repayment.

For more information please contact Alex Pawlowski, SOREDI Business Loan Manager at (541) 773-8946 or email alex@soredi.org.

The Southern Oregon Angel Investment Network is a SOREDI economic development initiative. Its purpose is to facilitate an opportunity for entrepreneurs seeking startup capital to collaborate with local accredited investors looking to make an investment in an early stage growth company. In its first three years 52 individual investors of the angel network invested $680,000 in three companies. In 2011 Folium Partners, an Ashland software developer received a $300,000 investment. In 2012 Montrue Technologies, also an Ashland software developer received a $160,000 investment. In 2013 JettStream, a Bend medical device startup received a $220,000 investment.

The Southern Oregon Angel Investment Network is a SOREDI economic development initiative. Its purpose is to facilitate an opportunity for entrepreneurs seeking startup capital to collaborate with local accredited investors looking to make an investment in an early stage growth company. In its first three years 52 individual investors of the angel network invested $680,000 in three companies. In 2011 Folium Partners, an Ashland software developer received a $300,000 investment. In 2012 Montrue Technologies, also an Ashland software developer received a $160,000 investment. In 2013 JettStream, a Bend medical device startup received a $220,000 investment.

In its first three years a majority of companies considered by investors were Ashland based. These companies dont appear to be connected in any specific way and are not from similar sectors. Simply put, the Southern Oregon Angel Investment Network recognizes a unique culture of entrepreneurism, innovation and business or idea incubation exists in the Ashland community. From among 62 companies considered by investors in 2011 and 2012 the top two were from Ashland resulting in $460,000 in angel startup capital. Other Ashland companies such as YogiTune and JOMA Films have gone on to successfully raise capital outside of the local angel network due to experienced gained in the due diligence process.

Investors are in the midst of their fourth round of funding. This will culminate at the Southern Oregon Angel Conference on April 30 where five companies will be invited to compete for an estimated $200,000 investment.

To learn more and register for the event go to www.soredi.org.

Seed Fund- Sustainable Valley Technology Group helped to create the Southern Oregon Seed Fund, which invested $37,500 into three graduate companies from the fall 2013 business accelerator. The 12-week intensive is a custom experience for each company. The programs is overseen by an expert Board of Mentors for market research, legal, financial, branding, web development and operations coaching.

iGrant Program- Sustainable Valley also offers a very unique iGrant program that connects mentor companies with valuable facilities to start-ups for the commercialization of their technology. SVTG offers special financing support to firms capable of raising large funds through government grants and contracts for the development of patented or patentable technologies.

For more information on these incentive programs, contact Sustainable Valley Technology Group, Executive Director, Heather Stafford 541-414-0000

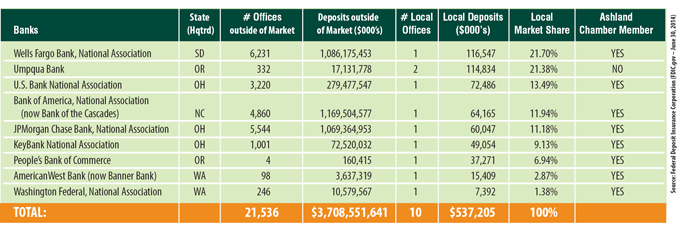

The financial needs of Ashland residents and businesses are well served by a variety of financial institutions. The city has ten bank (or thrift) branches located downtown and in other commercial areas of town. Two of these are Oregon-based institutions, catering to the business and consumer needs of Oregonians. There are five large national institutions included in those ten banks- Wells Fargo, JP Morgan Chase Bank, Key Bank, US Bank and Washington Federal. Ashland is also home to Rogue Credit Union, an Ashland Chamber Member.

The broad range of banking options assures borrowing need, including mortgage and business borrowing that can be met without leaving town.

These are the banks and where they are headquartered in order by Local Market Share: